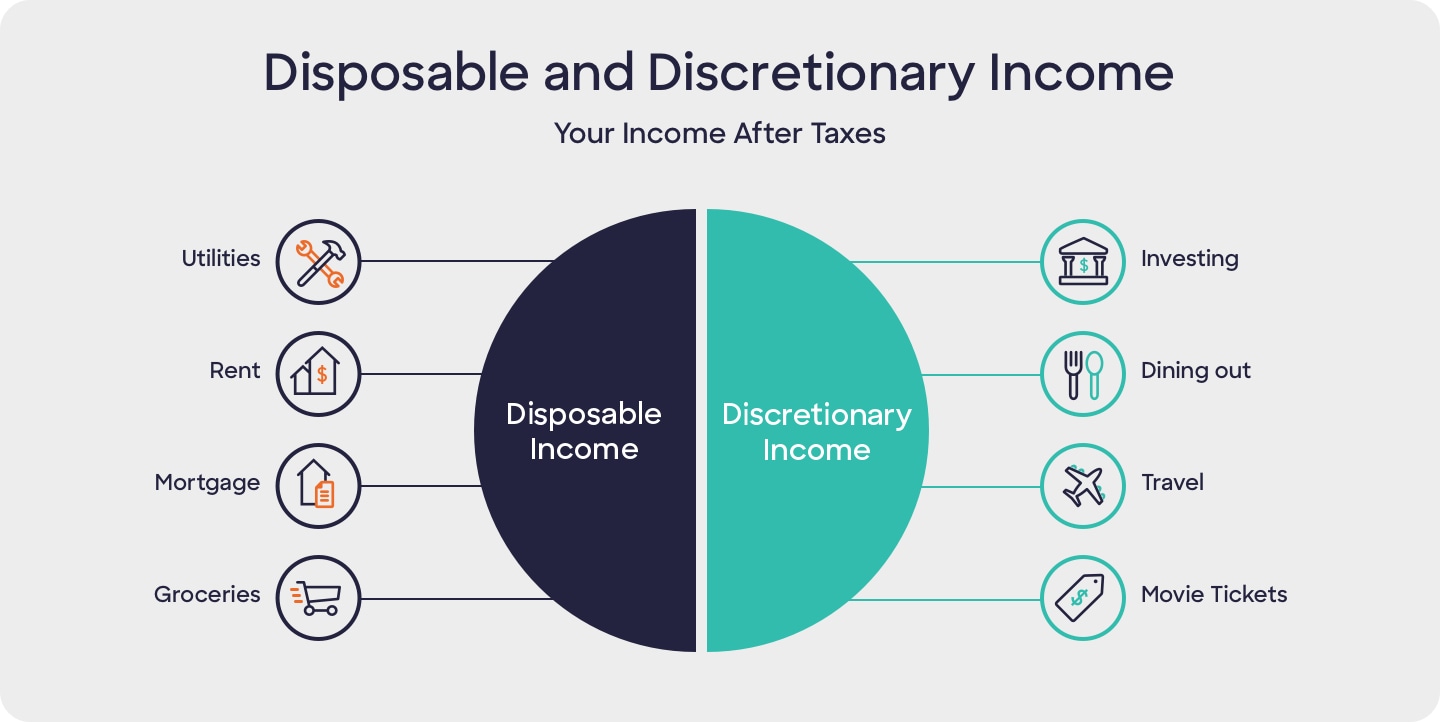

When it comes to personal finance, discretionary income plays an important role. You can think of it as the money left in your pocket after you take care of the essentials like utilities, gas, and housing. You can use this for spending, investing, or saving.

What is Discretionary Income?

6 min read

Last Updated: March 6, 2025

Next steps

See if you're pre-approved

View all Discover credit cards

See rates, rewards and other info

You may also be interested in

Was this article helpful?

Was this article helpful?