Cash Back Credit Cards

Find the best Discover cash back credit card for you

We’ll automatically match all the cash back you’ve earned at the end of your first year. There is no limit to how much we’ll match.1

Earn 5% cash back on everyday purchases at

different places you shop each quarter like

Grocery stores

Restaurants

Gas stations

up to the quarterly maximum when you activate.

Plus, earn 1% cash back on all other purchases.

Earn 2% cash back at

Gas Stations

Restaurants (including cafes and fast-food)

on up to $1,000 in combined purchases each quarter, automatically.2

Earn unlimited 1% cash back on all other purchases.

Benefits of Discover cash back credit cards

Get an unlimited dollar-for-dollar match of all the cash back you earn at the end of your first year, automatically. There is no limit to how much we’ll match.1

Your cash back never expires. Redeem your rewards for cash at any time.5

Discover is accepted nationwide by 99% of places that take credit cards.3

You're never responsible for unauthorized purchases on your Discover Card.8

We’ll help you regularly remove your personal info from select people-search websites that could sell your data. It’s free, activate with the Discover app.10

You can talk to a real person from our customer service team any time.11

Viewing your Credit Scorecard will never impact your FICO® Score.4

Low Intro APR

0% Intro APR† for 15 months on purchases and balance transfers and 3% Intro Balance Transfer Fee until July 10, 2025. Then 18.24% to 27.24% Standard Variable Purchase APR and up to 5% fee for future balance transfers will apply.

Ready to apply for a Discover credit card?

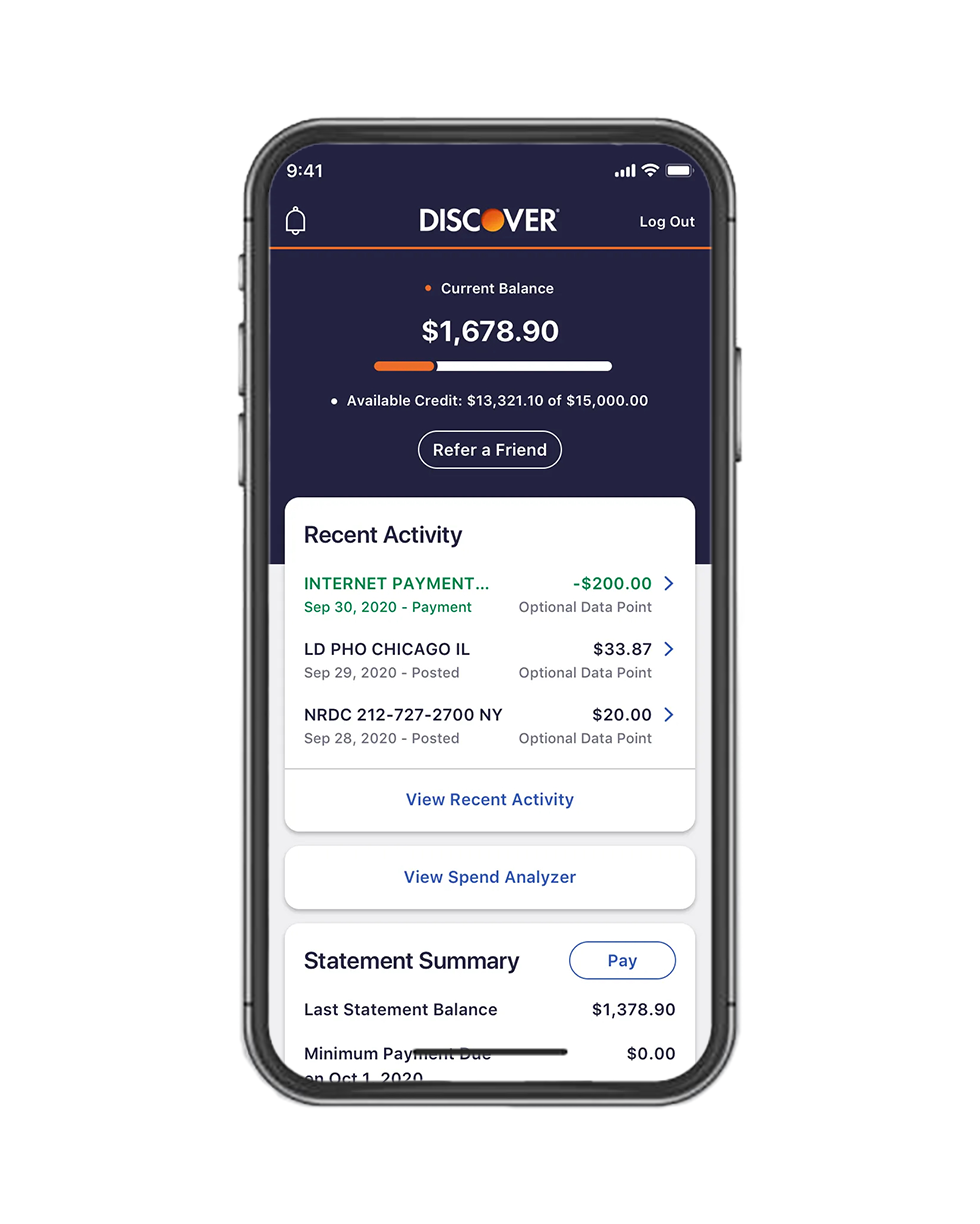

Bring your Discover account with you

on-the-go

Use your Discover student login to set alerts, viewing your Credit Scorecard will never impact your FICO® Score4 and more, all from your smartphone or tablet.