Action required: Update your browser

We noticed that you're using an old version of your internet browser to access this page. To protect your account security, you must update your browser as soon as possible. You'll be unable to log in to Discover.com in the future if your browser has not been updated. Learn more in the Discover Help Center

-

Credit Card Products

-

![Discover it Cash Card Art]()

- Discover it® Cash Back Earn cash back rewards

-

![Discover it Student Cash Card Art]()

- Discover it® Student Cash Back Start building credit in college

-

![Discover it Student Chrome Card Art]()

- Discover it® Student Chrome Earn restaurant & gas rewards as a student

-

![Discover it Secured Card Art]()

- Discover it® Secured Build or rebuild your credit

-

![Discover it Miles Card Art]()

- Discover it® Miles Explore with the travel rewards credit card

-

![Discover it Chrome Card Art]()

- Discover it® Chrome Earn restaurant & gas rewards

-

![Discover it NHL Card Art]()

- NHL Credit Card Represent your team & earn cash back

-

Student Credit Cards

Explore our best credit cards for college students

Discover® student credit cards let you earn cash back rewards and build a credit history5 while you're in college.

No annual fee. No credit score required to apply*

Intro purchase APR is x% for x months from date of account opening then the standard purchase APR applies. Intro Balance Transfer APR is x% for x months from date of first transfer, for transfers under this offer that post to your account by x then the standard purchase APR applies. Standard purchase APR: x% to x% variable, based on your creditworthiness. Cash APR: x% variable. Variable APRs will vary with the market based on the Prime Rate. Minimum interest charge: If you are charged interest, the charge will be no less than $.50. Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee: x% Intro fee on balances transferred by x and up to x% fee for future balance transfers will apply. Annual Fee: None. Rates as of . We will apply payments at our discretion, including in a manner most favorable or convenient for us. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment.

5% cash back at places you love to shop

Students earn 5% cash back on everyday purchases at

different places you shop each quarter, such as

Grocery stores

Restaurants

Gas stations

up to the quarterly maximum when you activate.

Plus, earn 1% cash back on all other purchases.

2% cash back at Gas stations and Restaurants

Earn 2% cash back at

Gas Stations

Restaurants (including cafes and fast-food)

on up to $1,000 in combined purchases each quarter, automatically.2

Plus, earn unlimited 1% cash back on all other purchases.

Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases – automatically.

Earn a 2% Cashback Bonus® at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus, earn unlimited 1% cash back on all other purchases.2

Get an unlimited dollar-for-dollar match of all the cash back you earn at the end of your first year, automatically. There is no limit to how much we’ll match.3

Get an unlimited dollar-for-dollar match of all the cash back you earn at the end of your first year, automatically. There is no limit to how much we’ll match.3

$0

$0

There’s a x% Introductory APR for your first x months. After that, an x% to x% Standard Variable Purchase APR will apply.

There’s a x% Introductory APR for your first x months. After that, an x% to x% Standard Variable Purchase APR will apply.

There’s a x% Intro APR for x months from the date of first transfer with a x% transfer fee, for transfers under this offer that post to your account by x. Learn more about how to do a balance transfer.

After the intro APR expires, your APR will be x% to x% based on your creditworthiness. This APR will vary with the market based on the Prime Rate.

There’s a x% Intro APR for x months from the date of first transfer with a x% transfer fee, for transfers under this offer that post to your account by x. Learn more about how to do a balance transfer.

After the intro APR expires, your APR will be x% to x% based on your creditworthiness. This APR will vary with the market based on the Prime Rate.

Enter to win a $5,000 scholarship from Discover®

The Discover® Scholarship Sweepstakes gives eligible students and parents a chance to win $5,000 for school. The earlier you enter, the more chances you have to win.16

See Official Rules for sweepstakes eligibility and entry requirements, entry deadlines and drawing dates, details including odds, list of eligible colleges and universities, prize descriptions and an alternate method of entry.16

What is the credit limit for Discover Student Credit Cards?

Different student credit cards offer different initial credit limits, which depend on factors like:

Your income

Your credit score

How much credit you’re already using (known as “credit utilization”), if applicable

There is no set credit limit as everyone's situation is different. The minimum credit line for Discover student cards is $500.

Three things to know about low APR credit cards for students

You will often find introductory offers for 0% APR student credit cards, but these are offers for a limited period of time. After your introductory period, the standard APR will apply to any balance remaining on your card and any new purchases. This is why it’s important to look at the standard APR when you compare credit cards.

Rewards and benefits designed for college students

Generous student rewards: Whether you choose the Discover It® Student Cash Back Card or Discover It® Student Chrome Card, you earn cash back on all your purchases.

Only Discover automatically gives unlimited Cashback Match to all new cardmembers: we’ll match all the cash back you’ve earned at the end of your first year.3 You could turn $10 cash back to $20. You could turn $50 cash back to $100. You could turn $100 cash back to $200.

Redeem any amount, any time. Rewards never expire:11 You can redeem your rewards for cash and in other flexible ways. And $1 cash back = $1 to redeem.12

Get paid when you tell friends: Refer a friend and get a statement credit for each friend who becomes a cardmember.4

No Annual Fee: Keep more in your pocket with no annual fee. So, you have more money to spend where it matters.

Low Introductory APR: Enjoy our low intro APR offers for new cardmembers so you can save on interest.

Use it where you love to shop: Discover is accepted nationwide by 99% of places that take credit cards.6

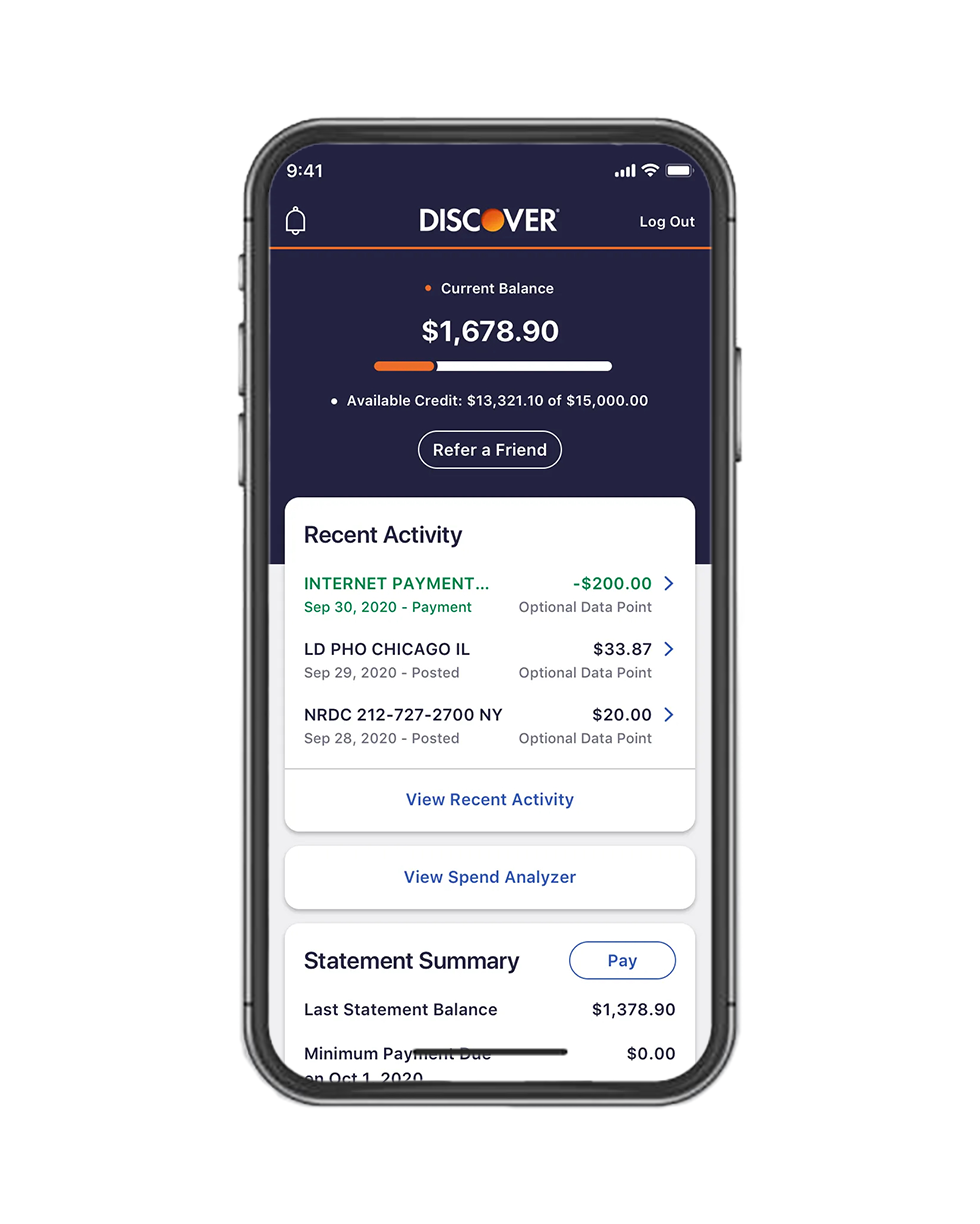

Manage your account on the go: Check your balance, make payments, view your transaction history, redeem your rewards, and more on the free Discover app or website.

FICO Credit Score for free: Once you’ve started building your history for six months you can check on it whenever you want – for free, right from the Discover app. Viewing your Credit Scorecard will never impact your FICO Score.1

Customizable card designs: Let your personality shine with a custom card that’s uniquely you. Choose from 20 different designs when you apply for a student Discover card – and from over 100 once your account is open.

24/7 Customer Service: Need help or have questions? Customer service is available any time, day or night.13

Email and Text Alerts: You can enable email and text alerts to make it easy to keep tabs on your account. Activate alerts for things like payment due dates or spending limits and we’ll send you notifications to your phone or email.

Fast, secure mobile login: Discover mobile app users can log in with Touch ID or your 4-digit passcode to see your balance, FICO® Credit Score, and more. Or, check your account without logging in using Quick View.

Learn more about Discover Mobile for iPhone and Android.

Online Privacy Protection: Discover gives you more control over your personal information online by regularly helping you to remove it from at least 10 people-search sites. It’s free, activate with the Discover app.8

$0 Fraud Liability Guarantee: You’re never held responsible for unauthorized purchases on your Discover Card.9

Free Social Security number alerts: We’ll monitor thousands of Dark Web sites and alert you if we find your Social Security number.14 Activate for free.

Account control at your fingertips: Lost Discover card? Freeze your account in seconds with an on/off switch either on the mobile app or website to prevent new purchases, cash advances, and balance transfers.15

Intro purchase APR is 0% for 6 months from date of account opening then the standard purchase APR applies. Intro Balance Transfer APR is 10.99% for 6 months from date of first transfer, for transfers under this offer that post to your account by x then the standard purchase APR applies. Standard purchase APR: 18.24% to 27.24% variable, based on your creditworthiness. Cash APR: 29.99% variable. Variable APRs will vary with the market based on the Prime Rate. Minimum interest charge: If you are charged interest, the charge will be no less than $.50. Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee: 3% Intro fee on balances transferred by x and up to 5% fee for future balance transfers will apply. Annual Fee: None. Rates as of May 31, 2024. We will apply payments at our discretion, including in a manner most favorable or convenient for us. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment.

Intro purchase APR is 0% for 6 months from date of account opening then the standard purchase APR applies. Intro Balance Transfer APR is 10.99% for 6 months from date of first transfer, for transfers under this offer that post to your account by x then the standard purchase APR applies. Standard purchase APR: 18.24% to 27.24% variable, based on your creditworthiness. Cash APR: 29.99% variable. Variable APRs will vary with the market based on the Prime Rate. Minimum interest charge: If you are charged interest, the charge will be no less than $.50. Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee: 3% Intro fee on balances transferred by x and up to 5% fee for future balance transfers will apply. Annual Fee: None. Rates as of May 31, 2024. We will apply payments at our discretion, including in a manner most favorable or convenient for us. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment.

Low intro student card APR

x% Intro APR† for x months on student credit card purchases. Then x% to x% Standard Variable Purchase APR will apply.

Intro purchase APR is x% for x months from date of account opening then the standard purchase APR applies. Intro Balance Transfer APR is x% for x months from date of first transfer, for transfers under this offer that post to your account by x then the standard purchase APR applies. Standard purchase APR: x% to x% variable, based on your creditworthiness. Cash APR: x% variable. Variable APRs will vary with the market based on the Prime Rate. Minimum interest charge: If you are charged interest, the charge will be no less than $.50. Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee: x% Intro fee on balances transferred by x and up to x% fee for future balance transfers will apply. Annual Fee: None. Rates as of . We will apply payments at our discretion, including in a manner most favorable or convenient for us. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment.

What is APR? An annual percentage rate (APR) is an interest rate that determines the finance charges you pay on your account if you carry a balance or take a balance transfer or cash advance. (Even if a customer pays the balance every month, we will charge interest on balance transfers and cash advances the day they post, so you cannot avoid interest charges for these types of transactions.)

Build your credit history5 in college

Whether you're brand new or already have some credit history, a student Discover Card lets you earn great rewards while you build credit with responsible use5. This includes making all of your payments on time to your Discover account or any other bills and loans.

Manage your account from anywhere

Use your Discover student login to set alerts, get your free Credit Scorecard with your FICO® Credit Score and more1 all from your smartphone or tablet.

Questions about Student Credit Cards

As a college student, you may have little or no credit history, so the best credit cards for you will be geared toward students in your situation. A rewards student credit card, such as Discover it® Student Cash Back Card or Discover it® Chrome for Students, can help you earn cash back on everyday purchases.

Discover reports your credit card account activity to the three major credit bureaus, so you start to develop a record of your financial activity. That’s why Discover student credit cards can help you build your credit with responsible use.5 (Plus, you earn cash back rewards on every purchase.)

It can be a simple process to start building credit. To build your credit responsibly with a student credit card:

• Make all payments on time.

• Pay your balance in full each month (or, if you can’t, at least pay more than your minimum due each month).

• Avoid carrying a balance: you’ll have to pay interest on any purchases or amounts you don’t pay off each month.

Things like late payments, failing to pay at all, or other negative activity with your student credit card or other loans in your name could hurt your ability to build credit.

When you apply online, here are some of the things you will need when applying online.

- Be at least 18 years of age

- Have a physical U.S. address

- Have a Social Security number

- Provide all the required information requested in your Discover application

- Show proof of education

You need to be at least 18 to apply for a student credit card and meet the income requirements for your age, but there's no credit score required to apply for a Discover student credit card.*

Discover student credit cards can help you build your credit history5 and earn cash back rewards on every purchase.

Regular credit cards are typically designed for people with an established credit history. These differ from student credit cards, which are designed with students in mind who may have little to no credit and are enrolled in school. It’s common for student credit cards to have a lower credit limit, so students can get started using credit and build credit with responsible use.5

Feel like you're ready to take on more credit? You can apply by requesting an increase online or you can call us at 1-800-DISCOVER.

When you graduate, call us to update your personal information, such as your income, housing, e-mail, and address. Updating this information may make you eligible for credit line increases.

No credit score is required to apply for a Discover it® Student credit card.* The Discover it® Student credit card can help you build credit with responsible use.5

Although you might need a new student credit card for a number of reasons, simply replacing your credit card if it is lost or stolen won’t affect your credit score. Also, you’re never held responsible for unauthorized purchases on your Discover Card account.9

Ready to apply for a Discover student credit card?

See if you’re pre-approved with no harm to your credit score.10

Brush up on credit card basics

See our helpful articles on student credit cards below.

Learn how to get your first credit card, including what card to apply for and what information you will need to get approved.

If you’re in school and considering a credit card for students, you probably have a lot of questions. This article will cover everything you need to know about student credit cards.

The key to happy card membership is to know what you’re doing from the start. Here are five tips for the first-time credit card holder.