NEXTQUARTER FIRSTMONTH. - NEXTQUARTER LASTMONTH. QUARTER YEAR

Discover it® Student Cash Back

Earn rewards and build a credit history3

No annual fee. No credit score required to apply*

Where can you get 5% cash back today?

CURRENTQUARTER FIRSTMONTH. - CURRENTQUARTER LASTMONTH. CURRENTQUARTER YEAR

QUARTER TITLE

QUARTER DESC11 QUARTER EXCLUSION CRITERIA

CURRENTQUARTER FIRSTMONTH. - CURRENTQUARTER LASTMONTH. CURRENTQUARTER YEAR

99% nationwide acceptance: Discover is accepted nationwide by 99% of places that take credit cards.2

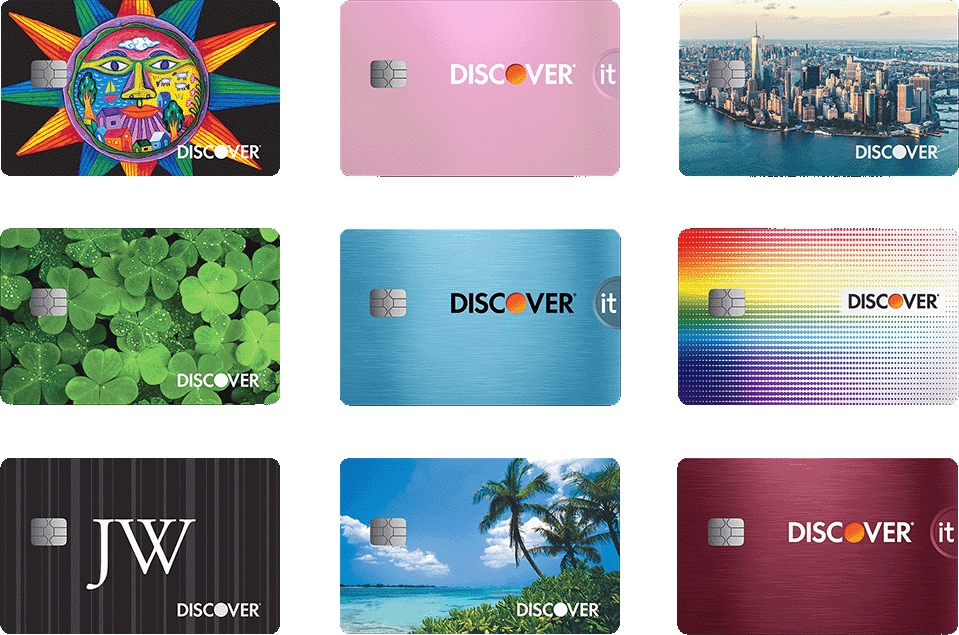

Which Discover it® Card design fits your style?

Choose from several colorful card designs when you apply to become a cardmember. Go ahead – express yourself.

Designed just for students

x% Intro APR† for x months on purchases. Then x% to x% Standard Variable Purchase APR will apply.

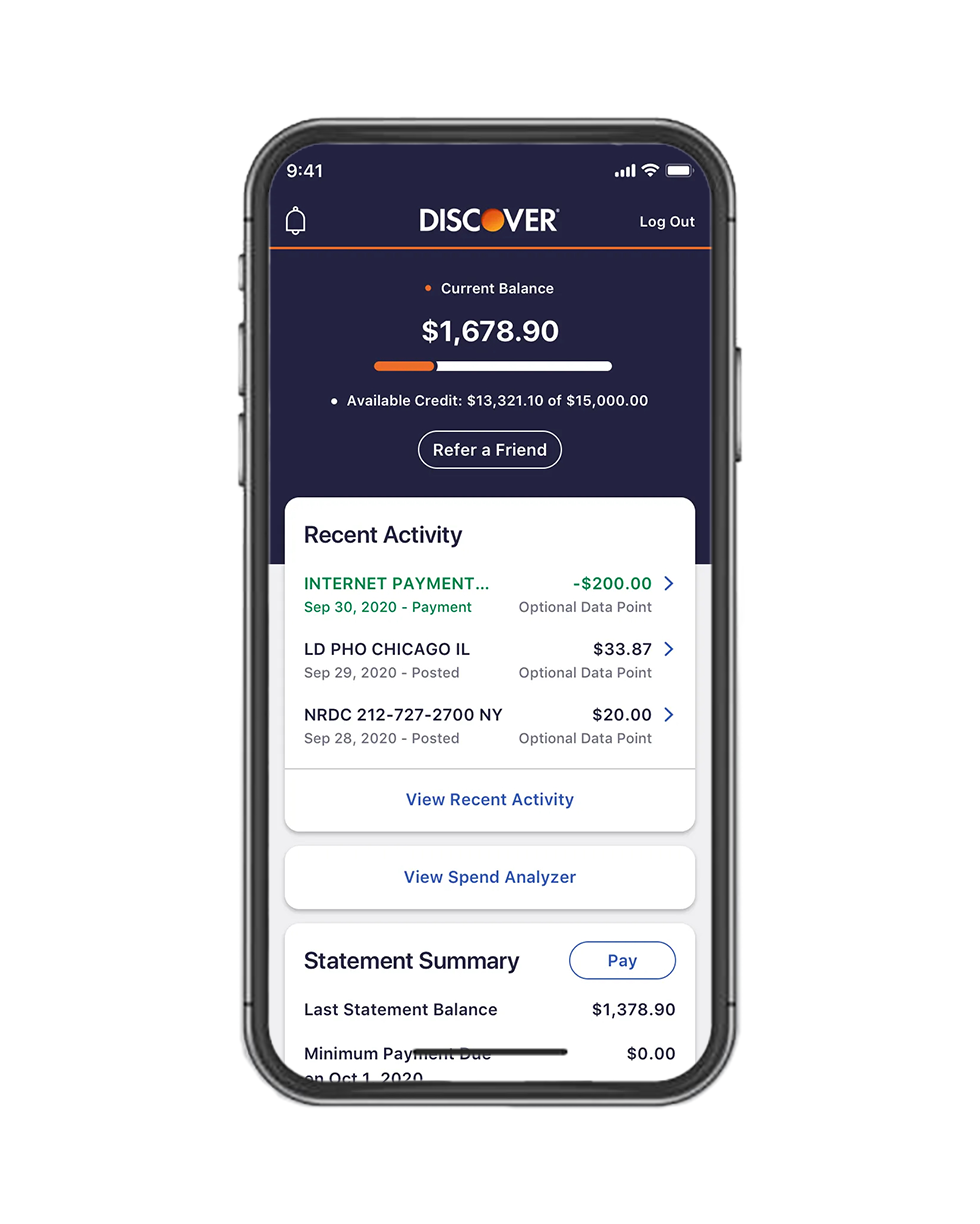

Bring your Discover account with you on-the-go

Use your Discover student login to set alerts, viewing your Credit Scorecard will never impact your FICO® Score4 and more, all from your smartphone or tablet.

Online Privacy Protection: We’ll help you regularly remove your personal info from select people-search websites that could sell your data. It’s free, activate with the Discover app.9

Track and redeem cashback reward

Easily message us for customer service right from our app

Free Social Security number alerts: Get an alert if we find your Social Security Number on any of thousands of Dark Web sites. 5 Activate for free.

Freeze it® - If you misplace your card, you can prevent new purchases, cash advances, and balance transfers in seconds with the Freeze it® on/off switch on our mobile app and website.6

Over 500,000 new student cardmembers referred by their friends since 2020

Refer a friend and get a statement credit for each friend who becomes a cardmember. Eligibility requirements apply. See terms and conditions.7

Looking to get started with a student cash back card?

See how the Discover it® Student Cash Back Card is a great place to start.

Credit card, secured or student credit card - what’s best for your teen? What they need to know before getting their first credit card.

Learn whether you’re ready for your first credit card, how to choose a starter credit card, and the best ways to build your credit history.3

From payments to rewards, ensure you start your credit history off right with these 7 tips for applying for your first credit card.