No matter your financial strategy, our Certificate of Deposit rates can help you earn more on your terms.

What are the benefits of a CD?

Guaranteed rates

Once your CD is opened, your interest rate is locked in with the specific CD term that you choose.

Hands off, on purpose

Pick your term and make your deposit, and then don't worry about a thing.

Strategic earning potential

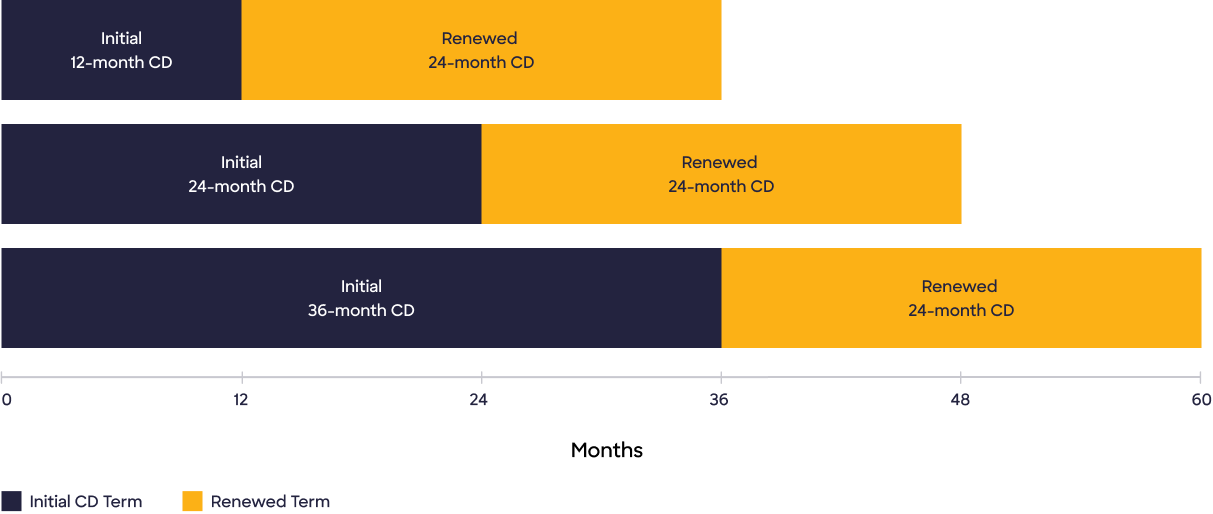

Add flexibility to your savings strategy with a CD ladder

Stagger your investment while taking advantage of guaranteed returns.

1

Define your goals

Decide how much you're willing to invest and how often you'd like access to your money.

2

Divide your investment

Open multiple CDs with varying maturity dates and spread your investment across each of them.

3

Renew or cash out

When each CD matures, you'll have the option to continue the ladder with a new CD or withdraw your money.

Goodbye, account fees

No. Fees. Period. That means you won't be charged an account fee on our CD account.*

Save with confidence—you’re FDIC-insured

- FDIC deposit insurance is up to $250,000 per depositor, per insured bank, per deposit ownership category

- May apply to retirement accounts

- Coverage is automatic

If you have more questions, call us at

†Annual Percentage Yield (APY) is accurate as of XX/XX/XXXX, is subject to change without notice, and will be determined and fixed for the term at funding. Applies to personal accounts only. A penalty may be charged for early withdrawal. No minimum deposit required to open an account.

*A penalty may be charged for early withdrawal from a CD.

**For more information on FDIC deposit insurance (including information on deposit ownership categories), or for help calculating your coverage, visit EDIE.FDIC.gov or call the FDIC at 1-877-275-3342 (1-877-ASKFDIC).