There is no minimum deposit to open a Discover CD Account.

CD ladders: Peace of mind for your money

A CD ladder lets you spread a lump sum of cash across multiple CDs to help you access your money more frequently.

-

More opportunities to withdraw your money

Opening multiple CDs with varying term lengths means you have more access to your money than a single long-term CD. -

Worry less about trying to time the market

If interest rates rise, you can take advantage of the higher rate the next time a CD in your ladder renews. -

Save with confidence

Every CD account you open is FDIC-insured up to the maximum allowed by law.

How to build a CD ladder

Define your savings goals

Divide your investment

Renew or cash out

Build your own CD ladder today

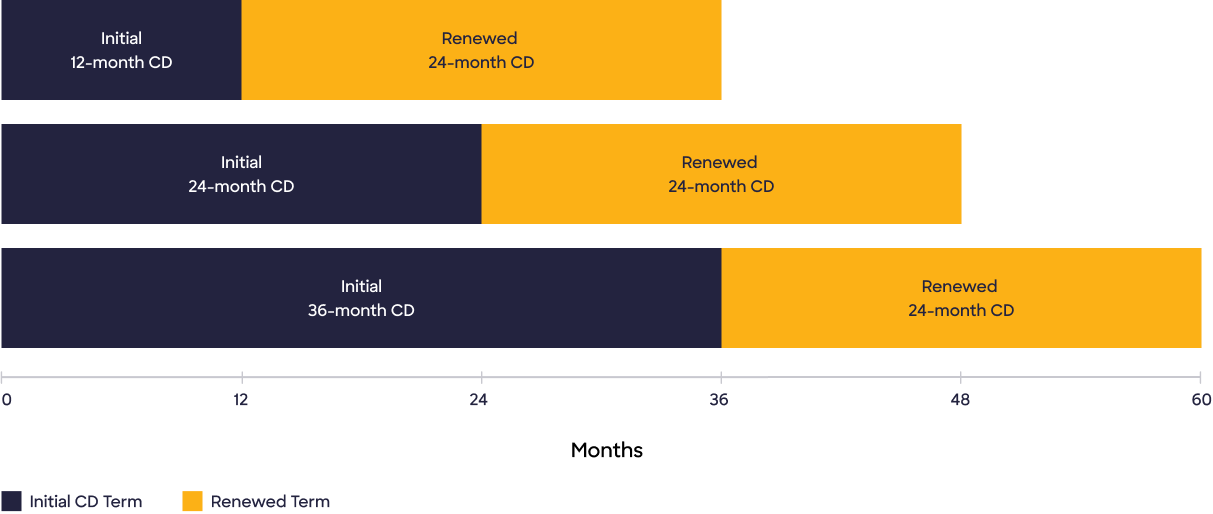

CD ladder vs a long-term CD

CD ladder

- More frequent access to your money

- Multiple CDs to manage

- Guaranteed returns

Example: $5,000 in a 12-month CD, $5,000 in a 24-month CD, and $5,000 in a 36-month CD.

Long term CD

- Less frequent access to your money

- One CD to manage

- Guaranteed returns

Example: $15,000 in a single 36-month CD.

CD ladder FAQ

View CD FAQ

How can I fund my CD Account?

At the time of application, you’ll have the option to:

Deposit Now—you can typically fund your CD account in one of the following ways:

- Transfer from an eligible Discover bank account you own (internal transfer)

- Transfer from an external bank account you own (external transfer via ACH)

Deposit Later—you can fund your CD account after your application is complete in one of the following ways:

- Transfer from an eligible Discover bank account you own (internal transfer)

- Transfer from an external bank account you own (external transfer via ACH)

- Mail a check that includes your CD account number, made payable to you, to:

Discover

P.O. Box 30417

Salt Lake City, UT 84130

*Please note that Travelers Checks will not be accepted.

- Send a wire transfer; for domestic wire transfers (from another bank in the U.S.), please wire funds to:

Beneficiary Bank: Discover, a division of Capital One, N.A.

ABA/Routing Number: 031100649

Beneficiary Bank Address (if required): 502 East Market Street, Greenwood DE 19950

Beneficiary Name: Your name (as it appears on your Discover CD account)

Beneficiary Address: Your address (as it appears on your Discover CD account)

Beneficiary Account Number: Your Discover CD account number

For more information about wire transfers or instructions for sending an international wire transfer, please refer to our “Wire Transfer” FAQ.

How is interest on my CD calculated?

Interest is compounded daily and credited to your account monthly.

When will I start earning interest on new deposits?

If we receive your deposit before your Account is opened, interest will begin to accrue on the deposit on the Business Day your Account is opened. Once an Account is opened, interest begins to accrue on a deposit on the Business Day we receive your deposit.

Is the CD Account FDIC-insured?

Yes, funds in Discover deposit accounts are FDIC-insured up to the maximum amount allowed by law. For more information, visit our FDIC information page.

Save with confidence—you’re FDIC-insured

- FDIC deposit insurance is up to $250,000 per depositor, per insured bank, per deposit ownership category

- May apply to retirement accounts

- Coverage is automatic