We do not charge any account-related fees. However, there is a $30 service charge for each outgoing wire transfer from your Discover bank account.

Explore the benefits of a Discover checking account

prev

Apple Pay is a service provided by Apple Payments Services LLC, a subsidiary of Apple Inc. Neither Apple Inc. nor Apple Payments Services LLC is a bank. Any card used in Apple Pay is offered by the card issuer. or Samsung Pay™ Samsung Pay is a trademark of Samsung Electronics Co., Ltd. Use only in accordance with law. Samsung Pay is available on select Samsung devices. and earn rewards on qualifying purchases.

Learn more

Some ATMs have limited hours and/or restricted access. You may be charged a fee by the ATM owner if you use an ATM that is not part of our no-fee network. If you encounter any issues using the ATMs displayed on this site, please contact us at 1-800-347-7000.

Overdraft Protection

Overdraft Protection will require a second account, which is typically a Money Market or Online Savings Account.

Learn more

Checking that checks all the right boxes

Comparison conducted by an independent research firm and based on data compiled in January 2025 from company websites, customer service agents, and consumer checking account offers. In some cases, competitors assess and/or waive fees if certain criteria are met. The non-Discover service marks for Chase, Bank of America, Wells Fargo, Chime, Capital One and Fifth Third are owned by each respective entity.

See how our Cashback Debit account compares to other banks across the board.

Competitive Features

Comparison conducted by an independent research firm and based on data compiled in January 2025 from company websites, customer service agents, and consumer checking account offers. In some cases, competitors assess and/or waive fees if certain criteria are met. The non-Discover service marks for Chase, Bank of America, Wells Fargo, Chime, Capital One and Fifth Third are owned by each respective entity.

|

Discover Cashback Debit |

Remove Bank

Chase Total Checking |

Remove Bank

Bank of America Advantage Plus |

Remove Bank

Wells Fargo Everyday Checking |

Remove Bank

Chime Chime Banking |

Remove Bank

Capital One 360 Checking |

Remove Bank

Fifth Third Momentum Checking |

|

|---|---|---|---|---|---|---|---|

|

1% cash back on up to $3,000 in debit card purchases each month Earn 1% cash back on up to $3,000 in debit card purchases each month. See Deposit Account Agreement for details on transaction eligibility, limitations and terms. |

Yes | No | No | No | No | No | No |

|

Access to over 60,000 NO-FEE ATMs in the U.S. |

Yes | No | No | No | Yes | Yes | No |

|

Fee-free overdraft protection transfer service Some competitors may have fees regarding excess number of transactions from a savings or money market account that may impact overdraft protection transfer services. |

Yes | Yes | No | Yes | No | Yes | Yes |

|

Get paid up to 2 days early with Direct Deposit Early Pay is automatically available to checking, savings (excluding IRA savings) and money market customers who receive qualifying ACH direct deposits. At our discretion, and dependent on the timing of our receipt of the direct deposit instructions, we may make funds from these qualifying direct deposits available to you up to 2 days early. See our Deposit Account Agreement for more information. |

Yes | No | No | Yes | Yes | Yes | Yes |

|

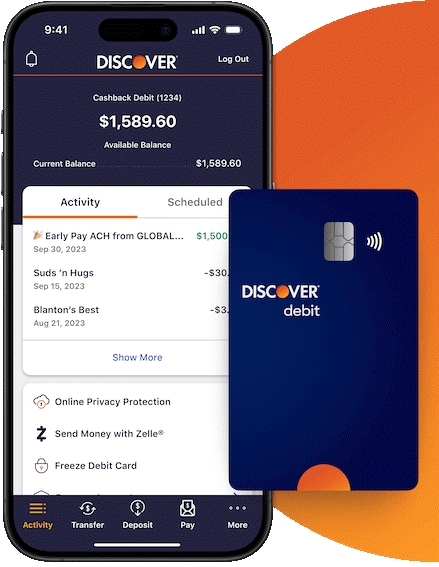

Send and receive money with Zelle® |

Yes | Yes | Yes | Yes | No | Yes | Yes |

|

Free help removing your personal info from select people-search websites. Activate by mobile app Online Privacy Protection is offered by Discover at no cost and only available in the mobile app. About every 90 days we will scan at least 10 people-search sites for your online personal information and help you submit opt-out requests. Types of personal information found on these sites will vary. |

Yes | No | No | No | No | No | No |

|

Freeze debit card When you freeze your debit card, Discover will not authorize new purchases, or ATM transactions, with that frozen debit card. Most other account activity will continue as normal, including previously scheduled and recurring transactions, internal and external transfers, deposits, online bill payments from the Discover Account Center, returns, credits, dispute adjustments, reward redemptions, and checks paid. |

Yes | Yes | Yes | Yes | Yes | Yes | Yes |

No Fees

Comparison conducted by an independent research firm and based on data compiled in January 2025 from company websites, customer service agents, and consumer checking account offers. In some cases, competitors assess and/or waive fees if certain criteria are met. The non-Discover service marks for Chase, Bank of America, Wells Fargo, Chime, Capital One and Fifth Third are owned by each respective entity.

|

Discover Cashback Debit |

Remove Bank

Chase Total Checking |

Remove Bank

Bank of America Advantage Plus |

Remove Bank

Wells Fargo Everyday Checking |

Remove Bank

Chime Chime Banking |

Remove Bank

Capital One 360 Checking |

Remove Bank

Fifth Third Momentum Checking |

|

|---|---|---|---|---|---|---|---|

|

No monthly fee (no balance or activity requirements) In some cases, competitors assess and/or waive fees if certain criteria are met. |

Yes | No | No | No | Yes | Yes | Yes |

|

No fee for insufficient funds Some competitors may have minimum thresholds before insufficient funds fees are applied and may have a cap on the number of insufficient funds fees charged in a timeframe. |

Yes | No | Yes | No | Yes | Yes | No |

|

No-fee official bank check |

Yes | No | No | No | No | No | $10 |

|

No-fee for expedited delivery of your replacement debit card |

Yes | No | No | Yes | No | Yes | No |

|

No-fee check reorder |

Yes | No | No | No | No | No | No |

Apply for a checking account online in minutes

Checking account FAQ

How do I earn Debit Card Cashback Bonus with my Discover Cashback Debit Account?

You may earn 1% cash back on up to $3,000 in debit card purchases each month*. That's up to $360 each year!

*Earn 1% cash back on up to $3,000 in debit card purchases each month. See Deposit Account Agreement for details on transaction eligibility, limitations and terms.

How can I make deposits to my Discover Cashback Debit Account?

You can deposit funds to your Cashback Debit Account in the following ways:

- Online transfer from an external bank account to your Cashback Debit Account

- Through Direct Deposit

- Deposit a check payable to you with Discover's Mobile Check Deposit Service using your mobile device.

- Mail a check that is made out to you with your account number on the memo line to:

Discover

PO Box 30417

Salt Lake City, UT 84130

What is Early Pay?

Early Pay is a free service from Discover that gives you access to funds from qualifying Automated Clearing House (ACH) direct deposits up to two days early and Tax Refunds ACH deposits from IRS up to five days early. Keep in mind that early access depends on when the payment initiator (or “Payor”), typically a business or government entity, sends us information that your deposit is on the way.

Early Pay is automatically available to checking, savings (excluding IRA savings) and money market customers who receive qualifying ACH direct deposits. At our discretion, and dependent on the timing of our receipt of the direct deposit instructions, we may make funds from these qualifying direct deposits available to you up to 2 days early (and up to 5 days early for your federal tax refund). See our Deposit Account Agreement for more information.

Does my Discover Cashback Debit account provide the option to enroll in overdraft protection?

Yes, your Cashback Debit account is eligible for enrollment in our overdraft protection service. Click here for more information about overdraft protection.