Updated: Nov 08, 2022

Article highlights

- You may be eligible for tuition discounts or waivers based on your family’s history at the school, military status, background, and more.

- Graduating in less time, whether through taking more classes each semester or enrolling in an accelerated degree program, can help you save money.

- Out-of-state students can get in-state prices through various reciprocity programs.

After deciding where you want to apply to college and putting together the best applications you can, the next challenge is figuring out how to pay for it. It doesn’t matter if it’s in or out of state or a public university or a private college, higher education is expensive. You probably already know that you should maximize college grants and scholarships, but here are more ways to help reduce tuition costs.

1. Maximize scholarship opportunities.

Start looking for scholarships while you’re in high school. You can use a free online search tool and talk to your high school counselor to find scholarships based on academics, hobbies and interests, family background, and more. But don’t stop there. Continue searching for and applying for scholarships throughout your college career to increase the amount of free money you can put toward tuition and other school expenses.

2. Look into tuition discounts.

Many schools offer tuition discounts for students in specific situations. For example, your college may offer a tuition discount if your siblings attend the same school, or if your parents or grandparents graduated from there (a legacy discount). And many schools offer a discount to veterans and current members of the military. Ask the schools you are interested in about any discounts they offer.

3. Find out if you qualify for a tuition waiver.

This form of financial aid is when your school waives, or discounts, a portion of your tuition. Typically, tuition waivers are given out for specific reasons. For example, some schools offer tuition waivers for financial hardship or low income or for specific backgrounds such as being Native American or having lived in foster care.

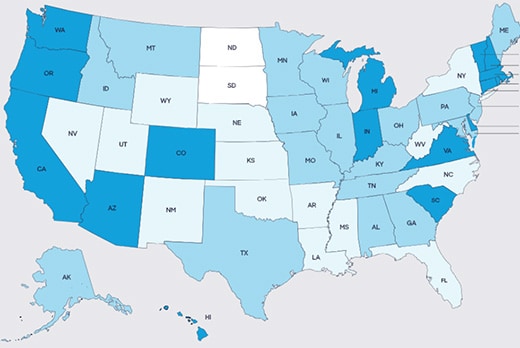

4. Ask about state or regional tuition exchange or reciprocity programs.

It may pay to stay in state. But in some cases, you may be able to go out of state and still save. Many states have agreements with other states that allow resident students to attend a college out of state without paying the higher tuition. There are also larger regional exchanges that involve multiple states. The details, opportunities, and restrictions vary from one program to another, so check with the school you are interested in to determine your eligibility.

5. Enroll in community college classes.

Tuition at a community college is typically lower than a four-year institution. You can enroll in community college classes to earn credits during the summer, start off at a community college and then transfer to a four-year institution, or enroll in both schools at the same time. Whichever path you choose, getting some of your credits at a community college can help reduce your overall tuition costs.

6. Trim back your room and board costs.

Dorm life can feel like a key piece of the classic college experience. But living and eating in the dorms and dining halls can be pricey. Look into a reduced meal plan if you can supplement by cooking in the dorms, consider more affordable college housing or living off-campus, or continue to live at home and commute to campus if you have that option. If you live off-campus, share costs with roommates and cook the majority of your meals at home to save on dining out.

7. Plan your courses thoughtfully. Try not to switch majors.

Before you register for your first-semester classes, review the general education requirements for your intended major and any related prerequisites, and create a loose plan of when you’ll take each one. By sketching this out in advance, you can make sure you complete all of these requirements within your timeline, and avoid paying for extra semesters of school. It’s great if you can choose the right major from day one, but if you start college undecided or want to change your major, you can always adjust the plan as you go. Note that when you switch majors, you could end up paying for classes that don't contribute to your degree, so put considerable thought into your decision and try to avoid changing multiple times.

8. Take more classes each semester.

At many schools, you pay the same price for full-time enrollment whether you take the minimum (i.e., 12 hours) or maximum credit hours (i.e., 18 hours). The more credits you earn each semester, the earlier you can graduate and stop paying tuition bills. If you think you can handle a larger course load, it’s worth checking your school’s policy to see what your options are.

9. Consider an accelerated degree program.

Some schools allow students to complete their requirements on an accelerated schedule, which lets them graduate in three years instead of four. Entering college with some credits already in hand, like those from AP® or community college classes, can make this easier to do. If you already know that you’re going to pursue a graduate degree after college, you can also look into combined undergraduate and graduate degree programs, which let you pursue both degrees in less time.

10. Research co-op programs.

These allow you to incorporate on-the-job experience with your coursework as part of your education. Students who participate often alternate traditional in-class semesters with those spent working full-time (for pay) in their field of study. The money you earn does not affect your financial aid eligibility and you can use it to help pay your tuition bills.

AP® is a trademark registered by the College Board, which is not affiliated with, and does not endorse, this site.

Recommended for you

See all >

Look forward to a brighter future.

Enter to win a $5,000 scholarship for school.

*NO PURCHASE OR CREDIT CARD APPLICATION OR ACCOUNT NECESSARY. Sweepstakes open to residents of the 50 United States (DC) and the US Territories 18 years or older. Sweepstakes starts 9/3/2024 and ends 8/31/2025. See Official Rules for eligibility and entry requirements, entry deadlines and drawing dates, details including odds, list of eligible colleges and universities, prize descriptions and an alternate method of entry. Void where prohibited.

Sponsor: Discover Products Inc. 2500 Lake Cook Road, Riverwoods, IL 60015