Updated: Feb 08, 2022

Student loans are designed to help you cover qualified education expenses, like tuition, fees, and on-campus housing. After your school certifies the requested loan amount and your student loan funds are disbursed, they typically go straight to the school, who applies it to your account. But if your loan is larger than your bursar account balance (to include things like books, transportation, etc.), and there’s money left over, your school will likely issue that money to you, either as a check or a direct deposit into your bank account. This is commonly referred to as a "student loan refund."

What student loan refunds can be used for

Money issued to you as a student loan refund is supposed to cover the costs associated with attending college that aren’t tuition, fees, and on-campus housing. This could include textbooks, of course, but also off-campus housing, groceries for meals not covered by a meal plan, transportation (including travel to and from school for breaks), technology like a new laptop, printing fees, and more.

Of course, some students will want to use the cash towards things like clothing, takeout or restaurant meals, and even spring break trips. Resist the temptation! This is a misuse of your loan. Plus, you’ll need to pay interest on the funds, making any splurges more expensive in the long run.

Should you keep or return your student loan refund?

Sometimes you end up with more money in student loans than you really need. If this happens to you, you can contact your loan provider for details on how to return the money. (For federal loans, you’ll have 120 days to do so.) The advantage of doing this is that you reduce your overall student loan debt. And if you return the money in a timely fashion, you won’t have to pay interest on it.

If your loan is a direct, subsidized loan, you won’t accrue interest while you’re still in school. So if you know that you’ll need the money while you’re still in school, you might choose to hold onto it for the short term (like if you’re planning to buy a new computer next semester).

Not sure how much money you’ll need this semester? The Discover® Student Loans loan amount calculator can help you estimate how much you’ll need to take out in student loans.

Other ways to pay for school expenses

Your student loan refund is meant to help you pay for books, transportation, and other living qualified expenses associated with your education. But if you can find another source of funds for those things and return your refund, you’ll graduate with less debt—something your future self will thank you for. Getting a part time job can help offset some of these costs, as can working during the summer and school vacations, and saving the money to help you during your school semesters. You can also apply for more scholarships; Discover Student Loans Free Scholarship Search lets you search over 4 million scholarships worth more than $22 billion. No registration required.

Look forward to a brighter future.

Enter to win a $5,000 scholarship for school.

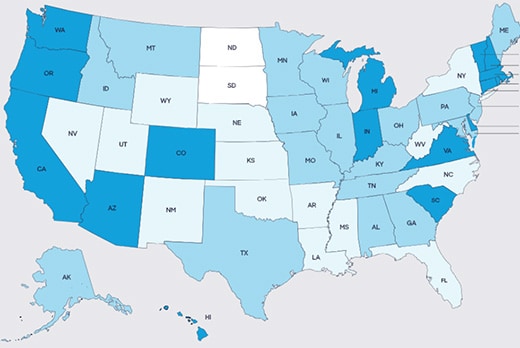

*NO PURCHASE OR CREDIT CARD APPLICATION OR ACCOUNT NECESSARY. Sweepstakes open to residents of the 50 United States (DC) and the US Territories 18 years or older. Sweepstakes starts 9/3/2024 and ends 8/31/2025. See Official Rules for eligibility and entry requirements, entry deadlines and drawing dates, details including odds, list of eligible colleges and universities, prize descriptions and an alternate method of entry. Void where prohibited.

Sponsor: Discover Products Inc. 2500 Lake Cook Road, Riverwoods, IL 60015